The BYD Shark 6 is coming soon and is set to be Australia's first plug-in hybrid ute.

As one of Australia’s largest novated leasing providers, we’re about helping you get the car you want while also providing the convenience and potential tax savings that come with salary packaging a car.

Thinking about an electric vehicle?

Because of the FBT exemptions tied up with the Electric Car (EV) Discount, you could enjoy 100% pre-tax payments on eligible EVs retailing up to the Luxury Car Tax threshold of $91,387#.

This could mean making similar payments on an EV that you would on an equivalent petrol car – despite the EV potentially retailing for considerably more!

How Much Could You Save on an EV Novated Lease?

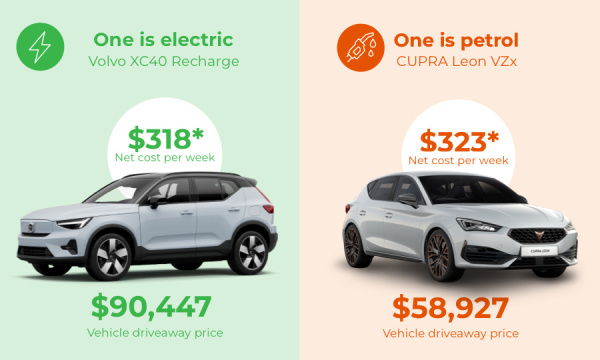

Electric Vehicles are currently more expensive than their petrol counterparts. However, with the Federal Government Electric Car (EV) Discount and novated leasing, you could pay around the same amount for a new electric car as an equivalent petrol car – potentially saving you thousands of dollars.

In this example, the electric car’s driveaway price is $30,000 more, yet you could pay less per week than the petrol car with a novated lease.

Our latest new car offers

If you could enjoy a great new car deal to complement the benefits of novated leasing, why wouldn't you?

Novated leasing: the whys and hows

Cars can be expensive – and a bother to keep track of when it comes to costs and upkeep. By salary packaging a car through Maxxia, you can soften the hip-pocket pain and remove much of the hassle.

Once you’ve decided on your car (which we can also help with) we establish a simple annual budget that rolls all your car’s running costs – including finance, petrol, servicing, registration and insurance – into one regular payment using a combination of your pre- and post-tax salary.

This means potential tax savings, no more juggling bills and due dates, and you don’t pay GST on the purchase price of a new car, either!

How does novated leasing compare to a car loan?

Hold the GST

That’s right – when you source a new car through Maxxia you not only get access to our nationwide buying power, meaning competitive prices on an extensive range of new cars, but you don't pay GST on the purchase price. Our nationwide buying power gives us access to lots of great cars – and great deals.

Potential tax savings

Because part of your car payments come from your pre-tax salary, your taxable income could be less. (Once your deductions commence, your payslip will show the pre- and post-tax deductions made to Maxxia relating to your novated lease.) With a regular car loan, you’d be making payments with your post-tax salary – and giving more to the taxman.

Access to competitive third-party pricing

As one of Australia’s leading novated lease providers, we have long-held relationships with suppliers and insurers nationwide, and can help you get competitive prices. No more worries about insurance coverage and over-charging mechanics.

Roll up, roll up

Cruising along an open road in your new car aside, it’s the convenience of a novated lease that many enjoy. In addition to your car repayment, all of those dreaded running costs – fuel, servicing, insurance and, most pertinently, registration – are rolled up into one regular payroll deduction. And the cherry on top? You could save on tax!

Can I choose the car?

You certainly can! In most cases you’re not limited to any particular car type, model or make. You’re not restricted to just new cars with a novated lease, either – you can lease a used car, or even your existing vehicle through a Sale and Leaseback arrangement. (Some conditions may apply and generally, the car you wish to lease should be no older than seven years at the end of the lease term.)

*Please refer to our website for full terms and conditions

#From 1 April 2025, a plug-in hybrid electric vehicle will not be considered a zero or low emissions vehicle under FBT law. However, your employer can continue to apply the exemption if both the following requirements are met: 1) Use of the plug-in hybrid electric vehicle was exempt before 1 April 2025. 2) You have a financially binding commitment to continue using the vehicle for private use on and after 1 April 2025. For this purpose, any optional extension of the agreement is not considered binding.

Phone: 1300 123 123

URL: maxxia.com.au

Things you need to know: This general information doesn't take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, and you should consider if they are acceptable before you accept any arrangements with Maxxia, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may pay and/or receive commissions in connection with its services.

Privacy Statement: By submitting this form, I agree to Maxxia contacting me about its products, services and offerings. I understand Maxxia will collect my personal information and that I can read more about how Maxxia handles my personal information by reading Maxxia's Privacy Statement.

Maxxia Pty Ltd | ABN 39 082 449 036.