What does this do?

Estimating your tax savings helps you understand the potential financial benefits of your current salary packaging arrangements.

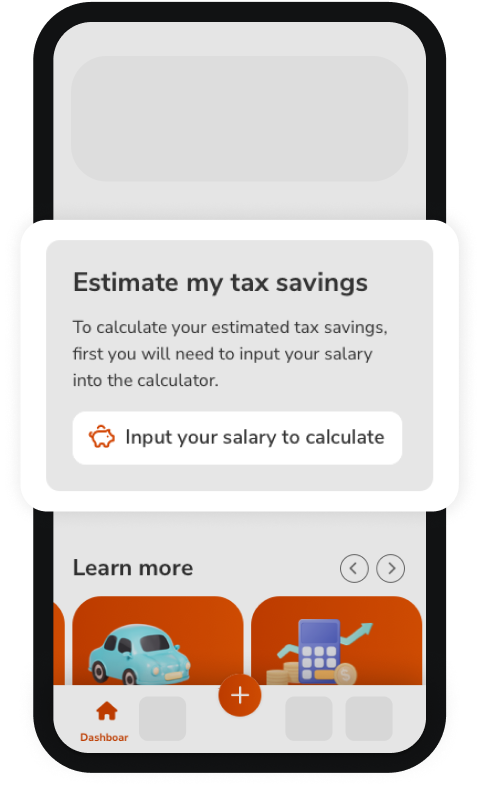

Accessing the tax savings calculator

From the main dashboard, follow the “Input your salary to calculate” link under the “Estimate my tax savings” section.

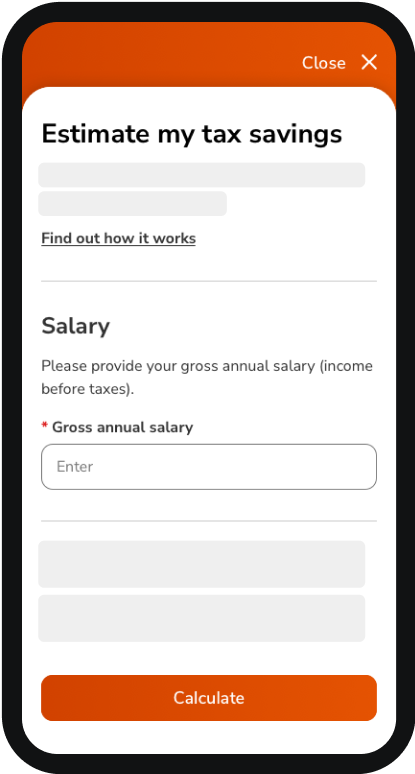

Inputting your information

- Follow the prompts to enter your current salary before packaging/novated leasing.

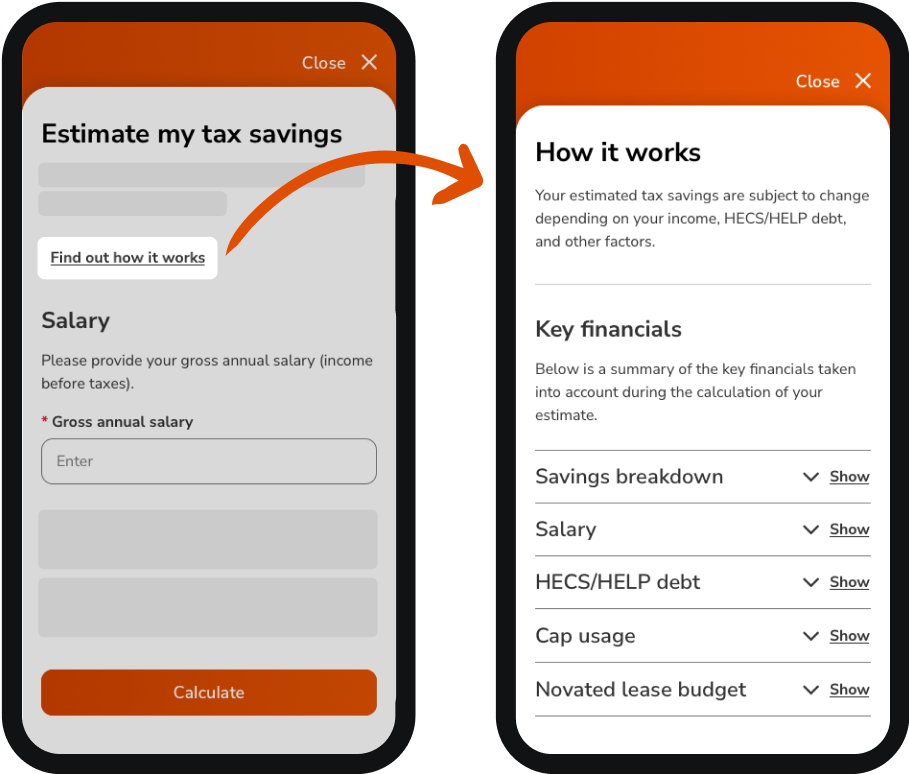

- Select “Find out how it works” for a breakdown of how your estimated tax savings are calculated.

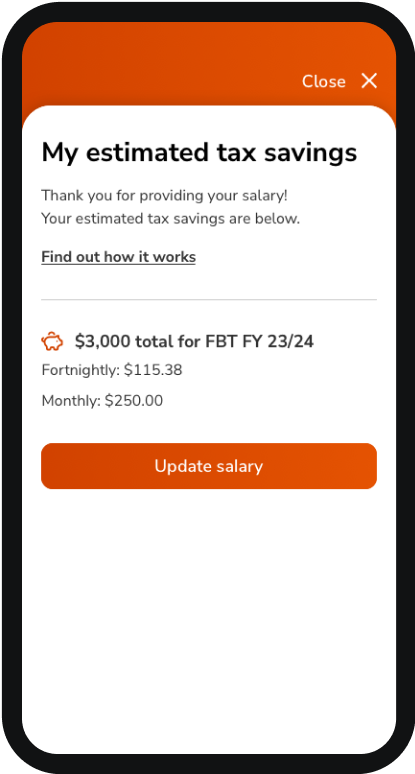

Viewing your estimated savings

After entering your information, the app will calculate your estimated tax savings. You will now be able to view your estimated tax savings for the FBT year.

If your salary changes, you will need to update your salary through this process to get a new tax savings estimate.

Important note

This is an estimate based on current tax rates and your inputted information. Actual savings may vary. Consider consulting a financial advisor for personalised advice.