I Work for a Charity Organisation, How Much Can I Salary Package?

If you’re employed by a not-for-profit or charity organisation, we have some good news.

Eligible workers can salary package up to $15,900 in living-expense items that attract Fringe Benefits Tax (FBT) – which could lower your taxable income and potentially increase your disposable income each year.

That's $15,900 annually!

What this means is that, dependent on your employer, you could be eligible to package up to $15,900 on costs that you’d ordinarily incur anyway – such as groceries, utility bills and mortgage or rent repayments. But now you’d be paying for them with tax-free dollars. (You can package a dedicated amount to just one of these, or spread it over any combination of them.)

But wait there’s more ($2,650 more)!

Additionally, you may also be entitled to package up to $2,650 in meal entertainment or venue hire.

And, as with other sectors, not-for-profits can package as many FBT Free benefits as they like – including self-education and work-related expenses – and they can also take out a novated lease in addition to the aforementioned caps.

How much could you save?

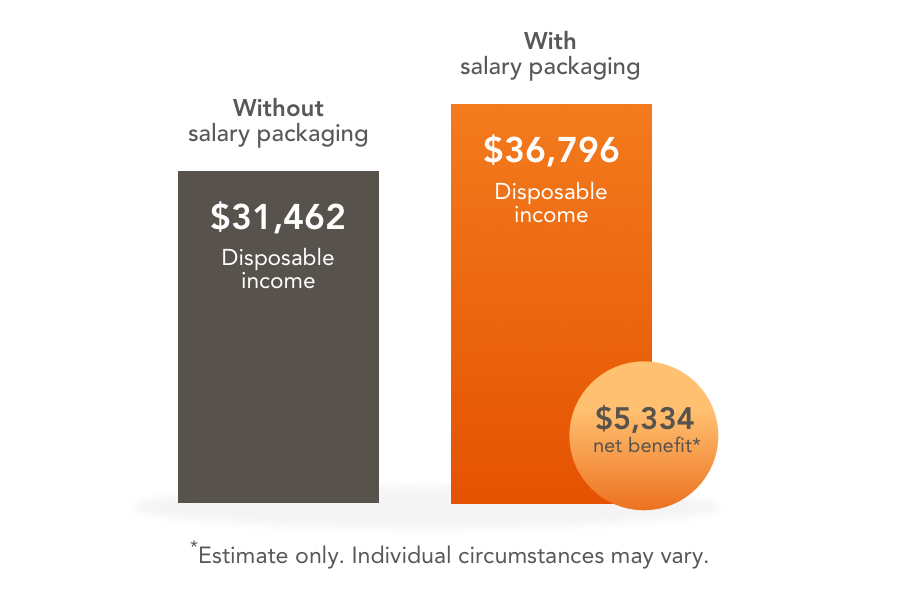

Let’s show you the potential difference in take-home pay when you salary package up to $15,900 in Living Expenses and $2,650 in Meal Entertainment per FBT year.

| Item | No Packaging | Packaging 2024/25 Tax Rates |

|---|---|---|

| Salary (Estimated) | $60,000 | $60,000 |

| Living Expenses | $0 | -$15,900 |

| Meal Entertainment / Venue Hire | $0 | -$2,650 |

| Net Cash Salary | $31,462 | $36,796 |

| Net Employee Benefit | $5,334 |

Assumptions: All calculations are for illustrative purposes only. The estimated potential tax benefit is based on the assumption that an eligible employee salary packages the specified amount and that Input Tax Credits (ITCs) are passed on by the employer. FBT rates effective 1 July 2023 and PAYG tax rates effective 1 July 2024 have been used, average fees and charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded. This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax and financial advice. Conditions and fees apply. The availability of benefits is subject to your employer’s approval.

Potential financial benefit on Living Expenses and Meal Entertainment.

- Annual Salary: $60,000

- Living Expenses Cap: $15,900

- Meal Entertainment Cap: $2,650

- Without Salary Packaging: $31,462

- With Salary Packaging: $36,796

- Net Benefit: $5,334

These tax exemptions can be significant – and definitely something to consider if you’re ever in the position of weighing up a job offer from a not-for-profit against a private company. Base salary doesn’t always give the full picture.

To find out if you’re eligible, speak to your employer, get in touch online, or give us a call on 1300 123 123.

Assumptions: Potential benefit of salary packaging living expenses based on an eligible employee salary packaging the full cap limit of $15,900. FBT rates effective 1 April 2023 and PAYG tax rates effective 1 July 2024 have been used. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit & Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded. Important information: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may receive commissions in connection with its services. Maxxia Pty Ltd | ABN 39 082 449 036.

This website contains general information and doesn't take your personal circumstances into account. Seek professional independent advice before making a decision.