What is a novated lease?

If you could pay less tax, get a great deal and enjoy budgeting convenience and the support of our expert teams through a novated lease, why wouldn’t you?

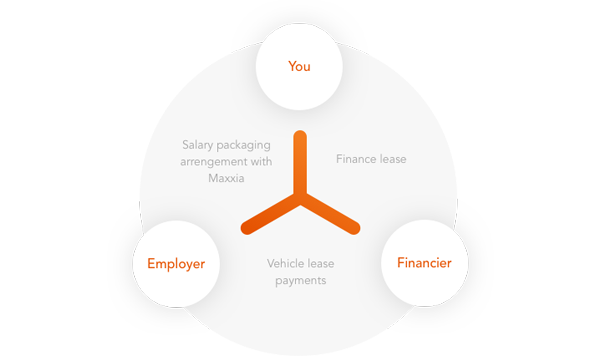

Available on new, used and even existing cars, novated leasing is an ATO-approved arrangement between you, your employer and a finance company that lets you use pre-tax dollars to pay for a car and its expenses.

Novated leasing also allows you to bundle not only your lease payments but your car’s running costs – including petrol, charging (if yours is an electric vehicle), insurance, rego and servicing – into one convenient regular payment.

So, how does novated leasing work?

Basically, a new, used or existing car is leased in your name, via your employer, and instead of paying with the money you have left over after tax, your lease is paid for via your payroll department with funds from a combination of your pre- and post-tax salary (or fully pre-tax on eligible electric, plug-in hybrid and hydrogen fuel cell vehicles).

While fringe benefits tax might apply, salary packaging a car could lower your taxable income and reduce the cost of getting into and running your next car.

A novated lease could benefit almost anyone who needs a car. You don't have to be a big earner or drive lots of kilometres to benefit. Best of all, with Maxxia you can rest assured you’ve got the life-of-lease support of one of Australia’s most experienced novated leasing providers.

If watching a video could help you pay less tax, why wouldn't you?

Different types of Novated Leasing

Novated Leasing - Financial Savings and Confidence