Less taxing, more relaxing

Embrace the good life by salary packaging

Meal Entertainment and Venue Hire

Embrace the good life by salary packaging

Meal Entertainment and Venue Hire

You could save on tax, that is.

The Meal Entertainment and Venue Hire benefit is a salary packaging benefit exclusively for the healthcare and charity industry. It’s often referred to simply as ‘Meal Entertainment’.

By adding Meal Entertainment to your salary packaging, you can access an extra $2,650 of your pre-tax salary. This is on top of any Living Expenses benefits you may have. The $2,650 cap limit resets each Fringe Benefits Tax year, which is 1 April – 31 March.

Meal Entertainment funds can only be spent on specific things – but guess what? They’re some of the best things, like dining out, accommodation or hiring a venue for a special event.

Go on that relaxing holiday, visit your favourite restaurant, all while potentially reducing your taxable income by salary packaging the costs.

Don’t get too stuck on the name! Meal Entertainment doesn’t cover your traditional ‘entertainment’, like a movie ticket. It’s about salary packaging the cost of dining out with others – imagine that the entertainment is your company.

The Venue Hire part of Meal Entertainment can be used to claim holiday accommodation, like your hotel bill or the accommodation portion of an all-inclusive holiday package.

Want to learn more about Meal Entertainment? Watch our Maxxia salary packaging explainer video here.

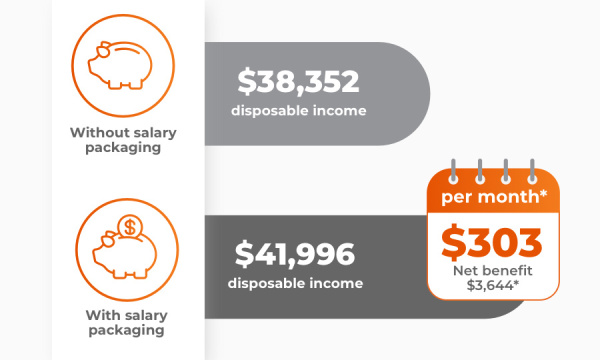

Sam works in healthcare and earns $60,000 a year. To possibly reduce his taxable income, he decides to take advantage of salary packaging benefits offered at his workplace.

Because Sam works in healthcare, he’s eligible to salary package $9,010 of his pre-tax salary for living expenses, plus $2,650 for approved Meal Entertainment and Venue Hire expenses.

For the Meal Entertainment benefit, he decides to claim $1,325 pre-tax dollars towards dining out costs for the year, and $1,325 to go on a holiday and pay for a nice hotel. This means he’s claimed the full Meal Entertainment cap limit and will receive the maximum potential tax benefit available to him in the Fringe Benefits Tax year (1 April – 31 March).

Thanks to salary packaging living expenses, meals and holidays, Sam was able to keep an extra $3,644 of his salary!

*Estimate only. Individual circumstances may vary.1

You don’t need to spend the entire $2,650 Meal Entertainment cap limit to take advantage of the potential tax savings. You can also change how much you package at any time.

The Maxxia Wallet card is the easy and convenient way to access your Meal Entertainment funds, 24 hours a day. No claiming, no invoices, we simply transfer your before-tax funds onto the Maxxia Wallet card and tap, tap, tap — away you go. Use the Wallet card to pay the bill next time you want to use your Meal Entertainment or Venue Hire funds.

Important things to know: There is an administration fee of $4.40 per benefit, per month (GST incl). This will be salary packaged and your deductions automatically increased to cover the charge. International transaction fees and disputed transaction fees also apply. Please refer to the Wallet’s Product Disclosure Statement for more information.

It’s easy to add Meal Entertainment as a benefit to your existing account. Log into Maxxia Online or the Maxxia app, visit the Contact page and follow the steps to make a change to your package.

Nominate how much of your pre-tax salary you’d like to allocate towards Meal Entertainment and allow a few weeks to see the change reflected in your pay.

It only takes a few minutes to sign up to Maxxia and start salary packaging your meals and holidays. Follow these 3 simple steps.

1Salary Packaging: The estimated potential tax benefit is based on the assumption that the disposable income is based on an eligible employee with an annual salary of $60,000 salary packaging to a $9,010 per annum limit and claiming $2,650 in venue hire and meal and entertainment expenses. PAYG tax effective 1 July 2024 have been used. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Your disposable income will vary based on your income and personal circumstances.

Important Information: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, and you should consider if they are acceptable before you accept any arrangements with Maxxia, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may pay and/or receive commissions in connection with its services.

The Meal Entertainment benefit has a maximum annual cap limit of $2,650. This will appear as a reportable fringe benefit on your Payment Summary each year which will be included in a number of income tests relating to certain government benefits and obligations. This cap is separate from the FBT cap limits for everyday living expenses.

General advice warning: This material is general information only. It does not take into account your particular/personal objectives, personal financial situation or personal financial circumstances. You should read the Product Disclosure Statement (PDS) for this product before making any decision on the new Card (Maxxia Wallet). You can read the PDS here. The Target Market Determination for this product can be found here.

Maxxia Wallet is a Prepaid Mastercard and is issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard Asia/Pacific Pte. Ltd. Maxxia Pty Ltd (Maxxia) ABN 39 082 449 036 is an Authorised Representative of EML Payment Solutions Limited Australian Financial Services Authorised Representative number 000278683 and participates in the promotion and distribution of the Card. Consider if the card is right for you. You should read the Product Disclosure Statement (PDS) for this product before making any decision on the new Card (Maxxia Wallet). You can read the PDS here. The Target Market Determination for this product can be found here. Mastercard and the brand Mastercard brand mark are registered trademarks and the circles design is a registered trademark of Mastercard International incorporated.

Maxxia Pty Ltd | ABN 39 082 449 036.